Due to the latest developments, the following question arises for many employers: How do I finance the wages of my employees? With short-time work compensation, the insurance company offers employers an alternative to impending layoffs.

Short-time work is the temporary reduction or complete cessation of work in a company, whereby the contractual relationship under labor law is maintained. The affected employees receive what is known as short-time work compensation for the loss of work. This amounts to 80% of the lost salary and is paid to the employer. In particular, short-time work also includes lost work due to official measures.

The requirements for short-time work compensation are that a lost work (per accounting period) consists of at least 10% of the working hours that are normally worked in total by the employees of the company and that the loss of work attributed to economic reasons is and unavoidable at a hunt.

All employees who are subject to ALV contributions and employees who have completed compulsory schooling but have not yet reached the minimum age for OASI contributions are entitled to short-time work compensation. There is no minimum period for making contributions to the ALV unless the employee is in a fixed-term employment relationship.

However, the law lists numerous exceptions in which short-time work compensation is excluded. Apprentices, employees with uncontrollable working hours, employees with shareholder status and their assisting spouses or employees with a fixed-term employment contract are not entitled to short-time work compensation. The law recognizes other exceptions, which must be checked on a case-by-case basis.

The employer must generally report the planned short-time work at least ten days before it begins to the cantonal office in writing using the registration form. Exceptionally, the registration period is three days if the employer can prove that short-time work has to be introduced due to sudden, unforeseeable circumstances.

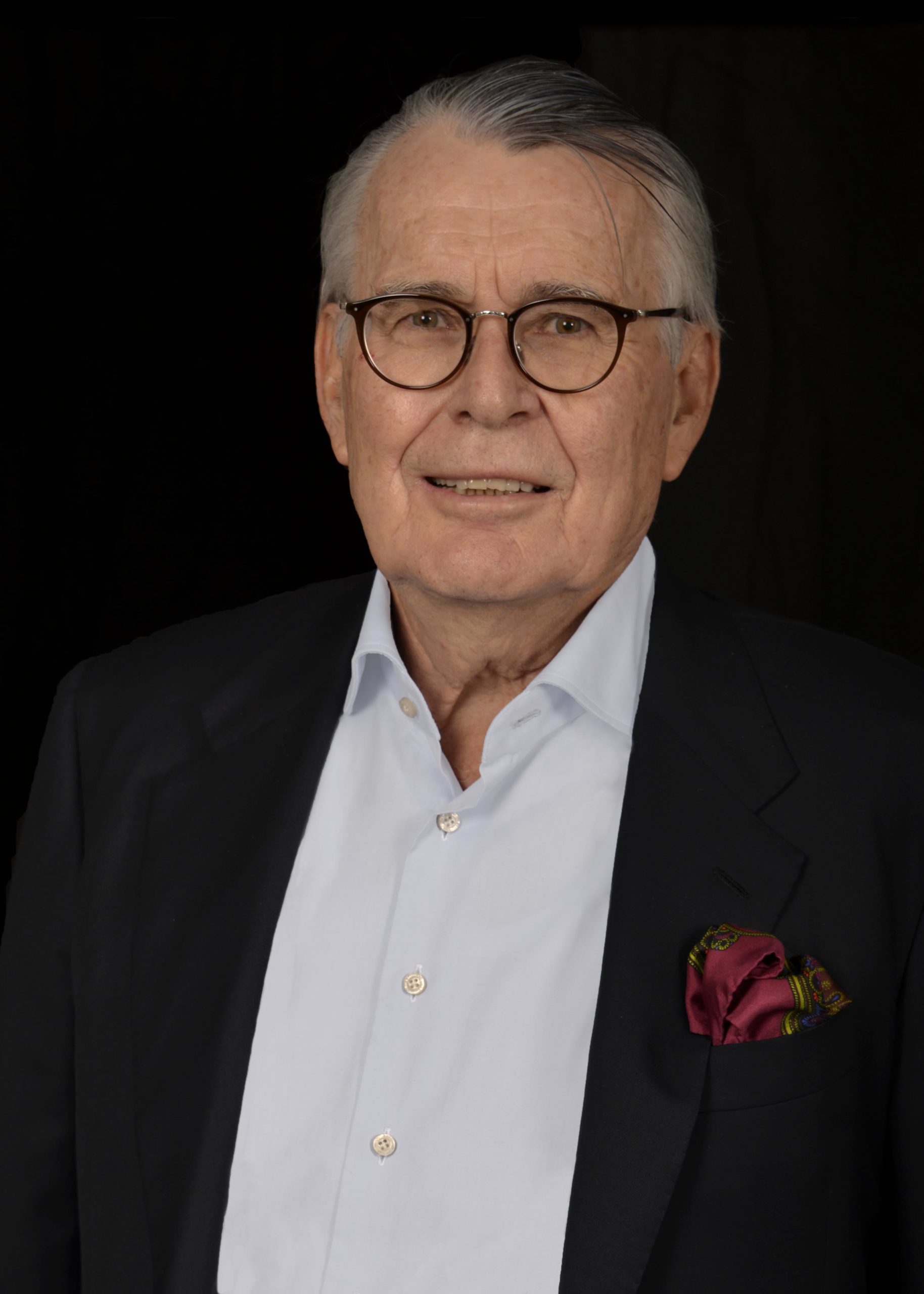

Experts